net operating working capital definition

Working capital is a measure of both a companys efficiency and its short-term financial health. Cash and short-term assets expected to be converted to cash within a year less short-term liabilities.

Days Working Capital Formula Calculate Example Investor S Analysis

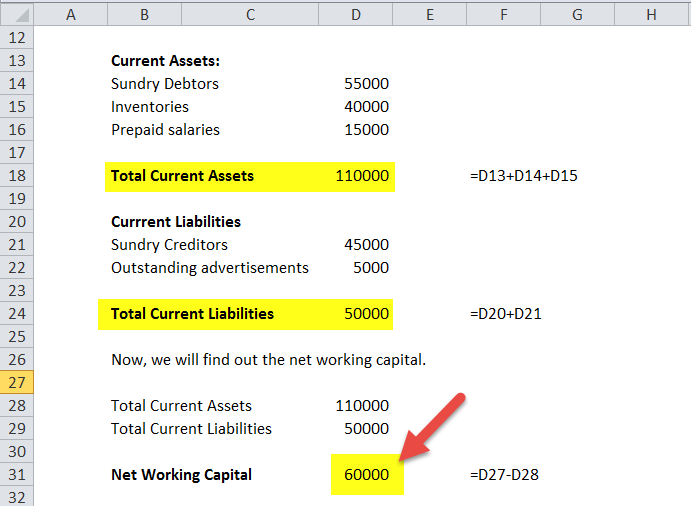

Net working capital is the difference between a businesss current assets and its current liabilities.

. Use the following formula to calculate the net working capital ratio. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial. Sample 1 Sample 2 Sample 3.

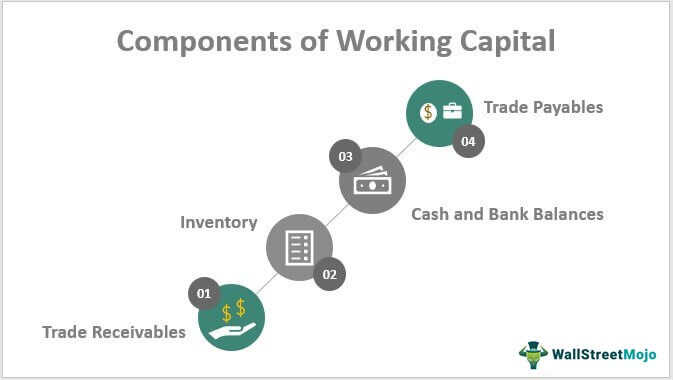

Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating and. Operating current assets are Cash Account Receivables Inventories Accounts Payable. For purposes hereof accounts payable.

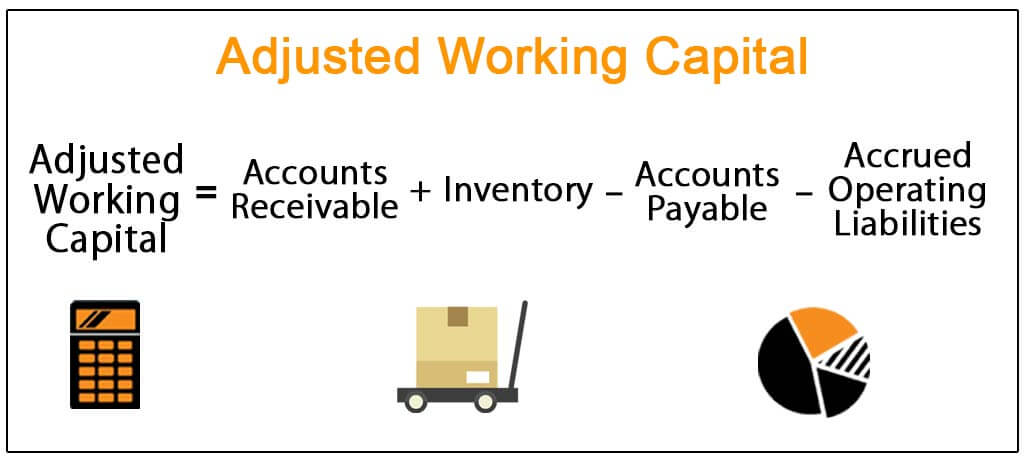

Working capital is calculated as. Operating net working capital means the sum of accounts receivable inventory and prepaid expenses minus the sum of accounts payable and accrued expenses excluding income taxes and interest. Define Estimated Net Operating Working Capital Adjustment.

Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. Current assets - Current liabilities net working capital ratio. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company.

Operating working capital definition and formula. Operating Working Capital means the sum of US 25 million composed by the entries of the Pro-Forma Balance Sheet including but not limited to i accounts receivable plus inventory and other current assets less ii accounts payable salary and contributions and other liabilities. Notwithstanding anything to the contrary in this Agreement Buyers right to audit and adjust the Closing Date Payment shall be limited solely to the audit and adjustment if.

Companies that have a large amount of NOWC versus their liabilities and accruals demonstrate that they have the potential to grow over time and also make investments if necessary. Operating Working Capital OWC Current Assets Accounts Receivable Inventory Value Current Liabilities Accounts Payable The current operating assets of a company are USD 100000 with an operating liability of USD 60000. Generally the larger your net working capital balance is the more likely it is that your company can cover its current obligations.

These assets include cash customers unpaid bills finished goods and raw materials. Has the meaning set forth in Section 31a hereof. The net working capital ratio is the net amount of all elements of working capital.

Businesses use net working capital to measure cash flow and the ability to service debts. Net working capital should be calculated on. Operating working capital is a narrower measure than net working capital.

Net working capital is calculated using line items from a businesss balance sheet. If the Estimated Net Operating Working Capital is less than 12600000 the Closing Date Payment shall be reduced dollar-for-dollar by the amount of such difference. Net working capital also includes net operating working capital which is the difference between a companys current operating assets and operating liabilities.

Working capital also called net working capital NWC is an accounting formula that is calculated by subtracting a businesss current liabilities from its current assets. Business accountants calculate net and net operating working capital the same way where the NWC current assets - accounts payable - expenses. Cash and other financial assets are typically excluded from operating current assets and debt.

Operating working capital is defined as operating current assets less operating current liabilities. The net operating working capital or NOWC is the value in excess of a companys operating current assets over the operating current liabilities. It is intended to reveal whether a business has a sufficient amount of net funds available in the short term to stay in operation.

How to Calculate Net Working Capital. Here is the requisite calculation formula. Then its OWC is USD 100000 USD 60000 which amounts to about.

Net working capital is the aggregate amount of all current assets and current liabilitiesIt is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in an efficient manner. Operating working capital focuses more on day-to-day operations whereas net working capital looks at all assets and liabilities. A positive net working capital indicates that the firm has money in order to maintain or expand its operations.

Working Capital What It Is And How To Calculate It Efficy

Adjusted Working Capital Definition Formula Example

Components Of Working Capital Top 4 Detailed Explained

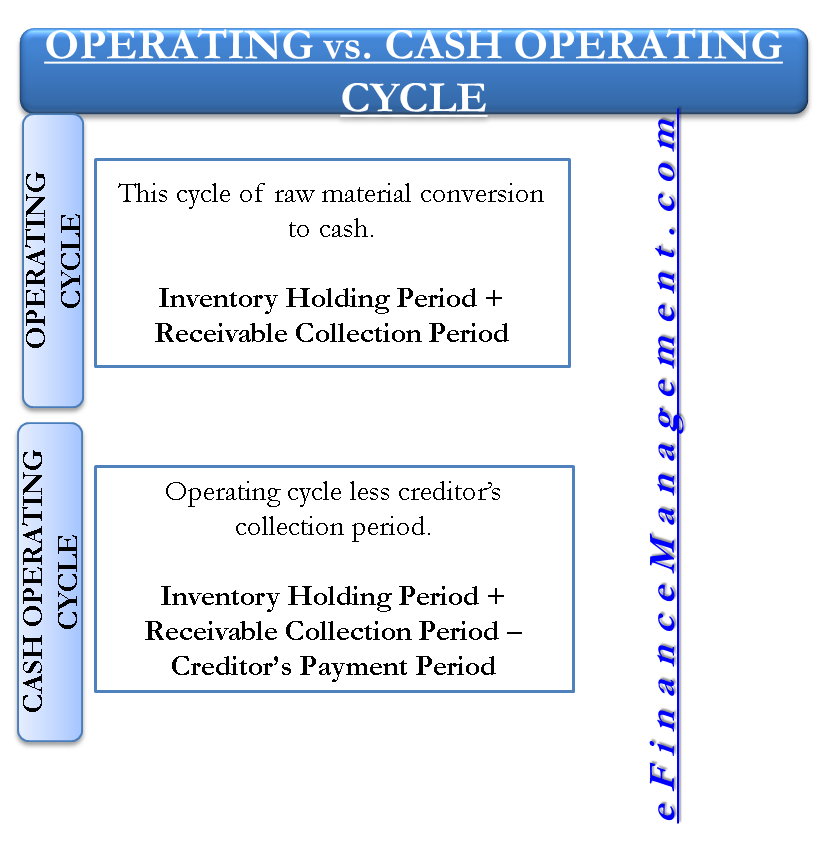

Operating Cash Operating Cycle Formula Calculation Example Analysis

Free Cash Flow To Firm Fcff Formulas Definition Example

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Definition Formula How To Calculate

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Net Working Capital Meaning Examples Formula Importance Change Impact

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

How To Calculate Working Capital Turnover Ratio Flow Capital

Net Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

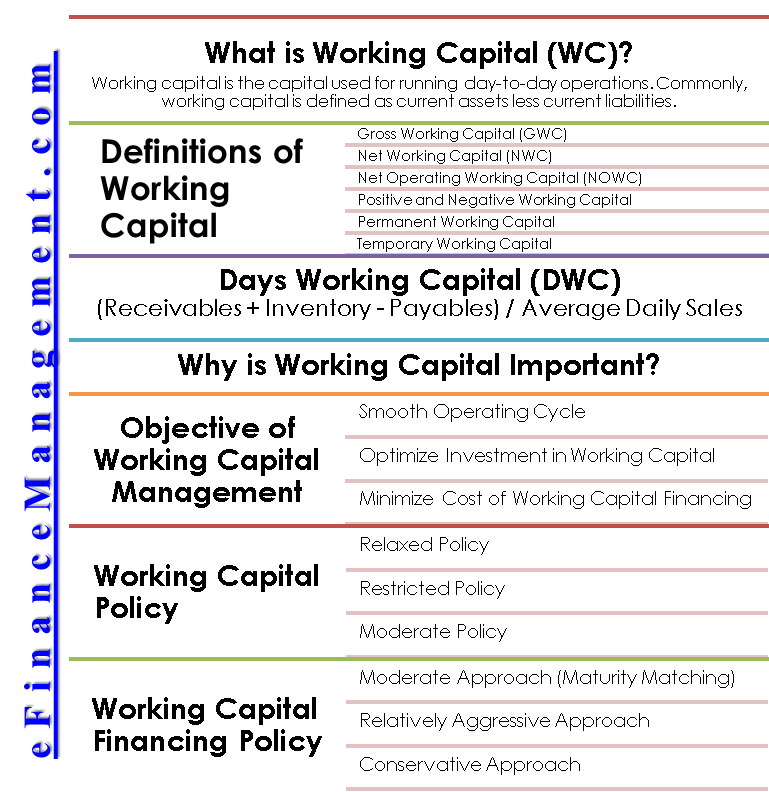

Working Capital Define Importance Objective Policy Manage Finance

Working Capital Cycle Efinancemanagement

Working Capital Ratio Analysis Example Of Working Capital Ratio